PGA Tour and LIV Golf Edge Closer to Merger as Terms Emerge

Progress towards a merger between the PGA Tour and the Saudi Arabia Public Investment Fund (PIF), which finances LIV Golf, is gaining momentum as both parties have recently exchanged term sheets. A framework agreement was initially struck in June 2022 between the PGA Tour, DP World Tour, and PIF, aiming to resolve the conflict sparked…

Progress towards a merger between the PGA Tour and the Saudi Arabia Public Investment Fund (PIF), which finances LIV Golf, is gaining momentum as both parties have recently exchanged term sheets.

A framework agreement was initially struck in June 2022 between the PGA Tour, DP World Tour, and PIF, aiming to resolve the conflict sparked by LIV Golf’s breakaway. This deal is projected to infuse £1.18 billion into the PGA Tour and facilitate more frequent competitions among top golfers. However, despite this promising start, progress has been slow, with many deadlines missed, leading to doubts about the merger’s completion.

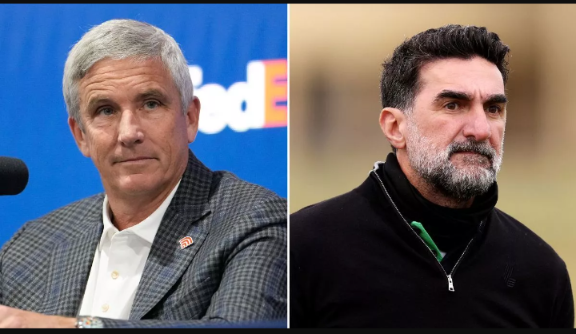

PGA Tour Commissioner Jay Monahan and PIF Governor Yasir Al-Rumayyan have been leading the discussions. Recently, notable PGA Tour policy board members, Jimmy Dunne and Mark Flaherty, resigned. Dunne, who was a crucial mediator between the PGA Tour and PIF, expressed frustration over the distribution of power within the board, particularly as player-directors like Tiger Woods, Jordan Spieth, and Patrick Cantlay assumed more control.

Rory McIlroy, who stepped down from the policy board in November and later attempted to rejoin, conveyed his pessimism about the deal’s prospects at the PGA Championship. He cited Dunne’s absence as a significant setback, emphasizing Dunne’s vital role in maintaining a positive relationship with PIF. “Jimmy was the key connection with PIF,” McIlroy remarked. “Without him, negotiations have stalled. It’s a huge loss for the PGA Tour.”

Despite these challenges, recent reports from the New York Times indicate that talks have advanced, with both sides detailing their terms for an agreement. The proposed deal would see the PGA Tour retain majority control over its enterprises, while PIF and the Strategic Sports Group—a consortium of American sports billionaires who also invested £1.18 billion in the Tour earlier this year—would hold minority stakes.

A major point of uncertainty remains LIV Golf’s future. Despite attracting high-profile players like Jon Rahm and Bryson DeChambeau with lucrative contracts, LIV has struggled to gain mainstream traction, reflected in disappointing viewership numbers. If LIV were to be sidelined in a merger, it could trigger an investigation by the U.S. Department of Justice (DoJ) on antitrust grounds. The DoJ would also likely scrutinize the merger for potential conflicts of interest, given the overlapping board memberships involved.

As the parties continue to negotiate, the outcome remains uncertain, with significant hurdles still to overcome before a definitive merger agreement is reached.